- Markets

- /

- Insights

Global Market Insights

Stay up to date on the latest global news and understand how it drives markets and can impact your investments

China's Evolving Economy, And The Pros And Cons Of Bond ETFs

This week we’re checking in on China’s economy after some better than expected data and another round of stimulus...

Now that interest rates are back at 2008 levels, we wanted to share what their earnings reports tell us about the economy..

If you’ve got variable interest rate debts outstanding, you may have noticed your repayments increase over the last 2 years. The more debt outstanding, the bigger the change. Well… imagine if you had $33 trillion in debt outstanding?

Welcome back to our regular schedule for Market Insights! Last week we wrapped up our 12-part Big Trends series, but that won’t be the last you hear of them...

For today though, we are looking at a topic that divides the room: nuclear energy. We didn’t cover it when we looked at Energy and Climate Change previously, because well, there’s a lot to cover...

This week we are having a look at the diverse and interesting field of nanotechnology. We’re going to have a look at what it is in the first place, the types of nanotech applications, and how to invest in the space.

The first is one of the oldest technology sectors around, and the second… well it seems to be perpetually on the verge of take-off...

This is part 9 of our ‘Big Trends’ series, and we are looking at another emerging trend, the Internet of Things (IoT). If you’re not familiar with this space, Oracle describes it as...

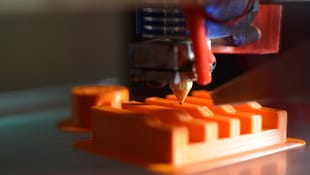

While the industry is still in its infancy, there’s already plenty of use cases for the technology, with more being developed as we speak. Most of the companies in the space are still tiny, but if you’re an investor with a tolerance for risk and a long time horizon, you might find the space worth considering for a portion of your portfolio!

We are now seven weeks into our ‘Big Trends’ series. This week we are looking at how technology has, and is, disrupting a few important industries, namely advertising, education and agriculture.

In this week’s piece, we’re going to cover some of the latest automation innovations across different industries, the benefits of automation to business and consumers, and how we as investors can get exposure to this trend!

We’re five weeks into our Big Trends series and this time, we’re looking into the huge world of cybersecurity! It’s been a decades-long game of tug of war, between hackers improving their offence and their targets improving their defence, and it’s only going to get bigger.